If your paying more than $99/month for power in Ohio, you might qualify for zero down solar panels. See if your zip code qualifies!

There Are New 2026 Solar Company Programs Available Now!

Find out if your zip code qualifies

How Does it Work?

The federal solar tax credit, also known as the investment tax credit (ITC), allows you to deduct 26 percent of the cost of installing a solar energy system from your federal taxes. The ITC applies to both residential and commercial systems, and there is no cap on its value.

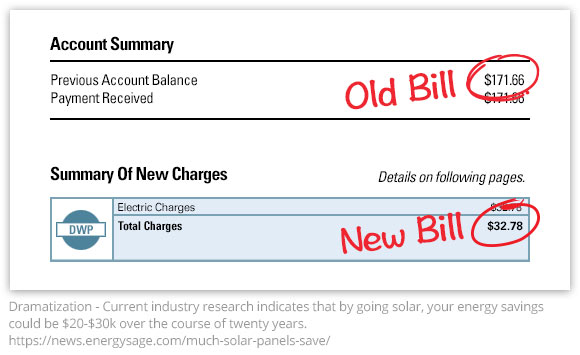

Homeowners like you in Ohio can go solar for little to $0 Down with a Solar Lease (PPA) and Save on Your Electric Bill. It's a serious score for homeowners! The best part about determining your potential savings is that there is absolutely no obligation. Get your no obligation free quote now!

Quick Summary: In the past it used to take up to 10 years to recoup your solar investment – now, with 2026 Solar programs, homeowners can use Solar Incentives to offset the cost of their solar installation and start saving money immediately. Click here to see if you qualify.

How Do I Find Out if I Qualify?

It's 100% free to see if you qualify, and takes about two short minutes.

Step 1: Click your state on the map to instantly check your eligibility for free

Step 2: Once you go through a few questions, you will find out if your area qualifies, and how much "going solar" can mean to your wallet!